GasRisk360

Modernized Risk Reporting for a European Gas Trading Desk

A leading European gas trading desk struggled with slow, manual risk reporting workflows using fragmented spreadsheets and outdated tools. The lack of real-time data, poor audit trails, and delayed risk visibility hindered both compliance and decision-making.

🛠️ Solution Overview

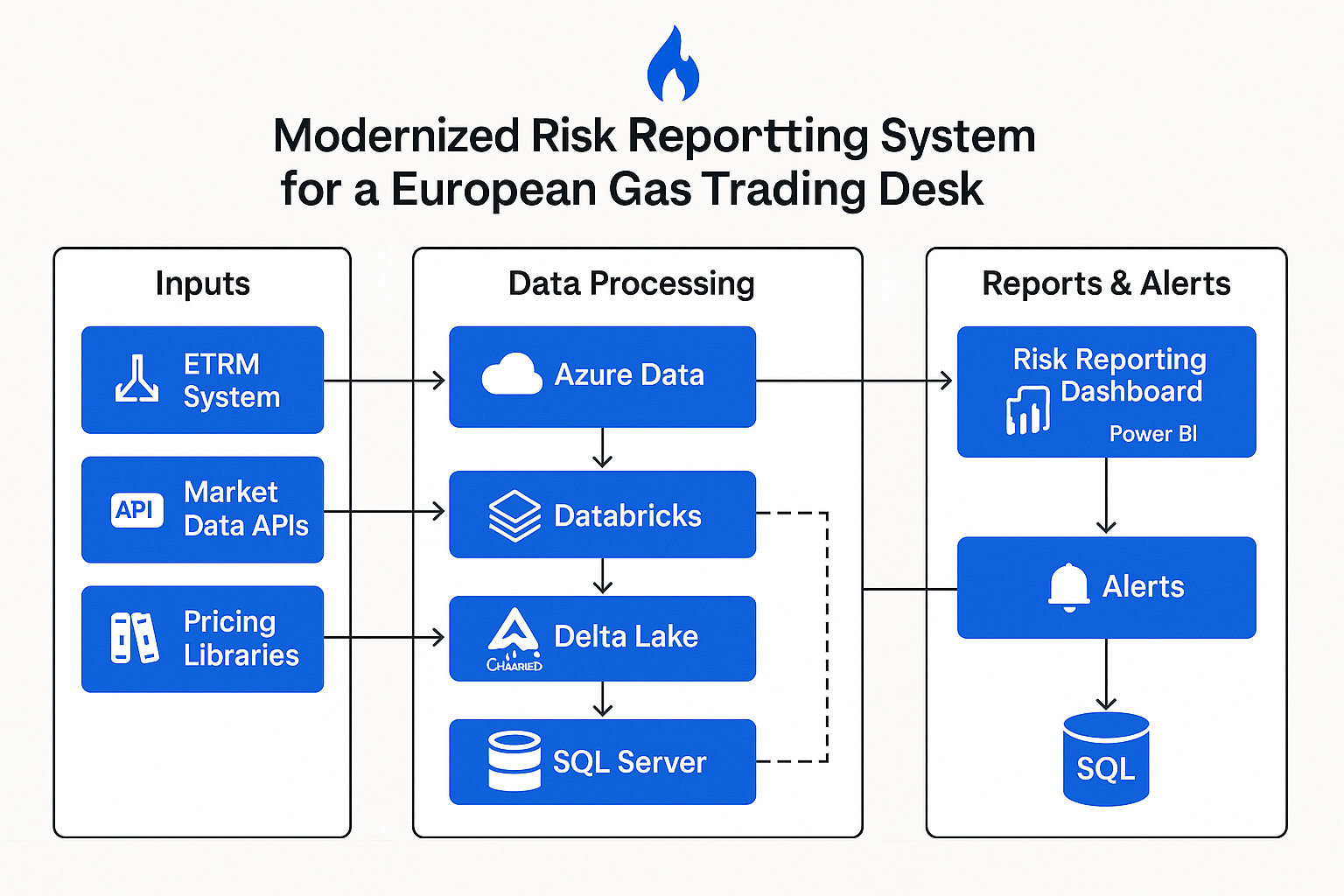

Our team delivered GasRisk360, an end-to-end risk reporting platform powered by modern data architecture. The system automatically ingests trade, pricing, and market data; processes it using distributed analytics engines; and delivers rich, real-time insights via intuitive dashboards.

Architecture of the Modernized Risk Reporting System

💡 Key Capabilities

- Real-time ingestion of trades, exposures, and market data

- Advanced risk metrics: VaR, PnL breakdown, stress scenarios

- Automated alerting for breaches and anomalies

- Audit-ready historical snapshots for EMIR/REMIT compliance

- Centralized reporting via Power BI dashboards

🧩 Tech Stack

Azure Data Lake: Raw data staging and archival

Databricks (PySpark): Distributed analytics and transformation

Delta Lake: Unified lakehouse layer with ACID guarantees

SQL Server: Structured queryable store for risk data marts

Power BI & Streamlit: Dashboards and alert interfaces

📈 Business Impact

- 4x faster risk reporting (from 4 hours to under 30 mins)

- Enhanced visibility across front office, risk, and compliance

- Zero-touch automation reduced manual intervention by 90%

- Scalable architecture ready for multi-commodity expansion